Take Five #004: Where self-funded searchers have an advantage over traditional search funds, and more

Five takeaways we loved at Kumo this week

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Take Five #004: Where self-funded searchers have an advantage over traditional search funds, and more

1. The best way to learn about search / EtA / holdcos / anything: “You just have to live the experience to figure out what works for you.”

From the team at Chenmark, on how they formulate their grand plans:

“We often get cold requests for introductory calls about our approach to search or our thoughts on starting a long-term Holdco. Sometimes, people want to know the intricacies of how our holding company was structured for investors before they have even bought a company, or our thoughts on whether they have a “good deal” under LOI.

Our answer is probably unsatisfying ‒ that it depends on what you’re trying to do. The reality is that the person has to figure out what works for them, make a decision, and figure it out from there.

There’s absolutely nothing wrong with doing your homework. However, Bjork illustrates that no matter how much one educates themselves about working with investors, conducting a search, or creating a holdco, the reality is that at the end of the day, you just have to live the experience to figure out what works for you. And what works for you is probably different then what worked for us. That’s probably why we rarely get inquiries from people actually operating companies. They already know this and have no use for us; they are busy doing the work.”

From “Grand Plan: We Had None” by Chenmark

2. “Don't let a good biz get away over small dollars on price.”

Great thread comparing two mental models on search:

3. Post-Acquisition Advice: Retaining the Previous Owner(s), Do's & Don'ts

Excellent shortlist on what a 25-year SMB veteran looks when transitioning ownership, with some gems in the comments like:

“There are some good reasons to retain previous owner but the key thing is to manage the perception of the workforce and how they view the previous owner. If the previous owner built a culture that is reflective of him/her, it will be a difficult transition. You also have to manage the tendencies of the previous owner - even though they are no longer the owners, they will have tendencies to still behave in a way that they are still the owners.”

From “Post-Acquisition Advice: Retaining the Previous Owner(s), Do's & Don'ts” on Searchfunder

4. Agonizing over valuations? Why valuations for SMBs (almost) irrelevant:

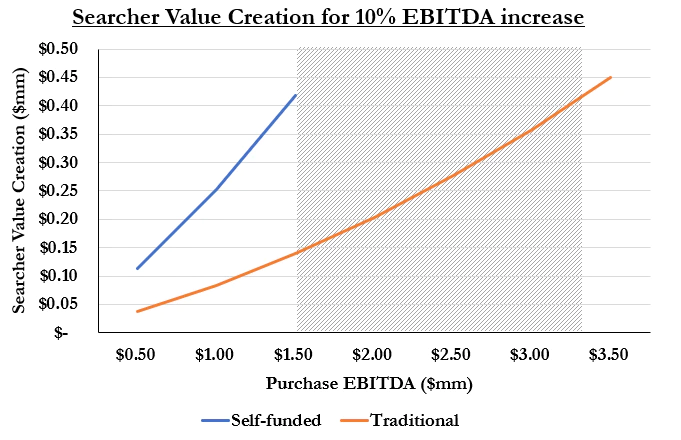

5. “TLDR: If you can stomach the risk of the personal guarantee, the self-funded model offers more upside, speed and flexibility than the traditional model.”

Excellent article from Buy Small Sell High on the sweet spot where self-funded searchers have an advantage:

“Since self-funded searchers keep roughly 3x as much equity as traditional searchers, traditional searchers need to acquire business that are 3x as large to have the same upside.

That leaves a “grey area” for companies between ~$1.5mm - $3.0mm of EBITDA where a searcher could have more upside by buying a significantly smaller business. Once the company size exceeds $3.5mm EBITDA, the upside for traditional searchers is higher than any self-funded search.”

From “Which Search Fund Model is Right For You?” by Buy Small Sell High

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.