Take Five #012: Send this blueprint of the $10 trillion dollar tsunami to a friend, and more

Five takeaways we loved at Kumo this week

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Before we jump into our Take Five: our beta for Kumo is LIVE! Try it for free now:

What is Kumo?

Kumo is a powerful deal aggregator to help supercharge your deal sourcing.

What can you do with Kumo?

With Kumo, explore the 60,000+ deals we’ve sourced so far (from 184K+ listings monitored) — and see hundreds of new deals each week from 40+ sources (we’re adding more data sources weekly!) Plus, you’ll be able to:

Filter deals by industry and category

See where the same deal is shared across multiple sites

See when deals are updated for the most recent information

Save deals for easy browsing later

Take Five #012: Send this blueprint of the $10 trillion dollar tsunami to a friend, and more

1. The $10 Trillion Tsunami (send this to a friend as a great primer for EtA):

If you know someone who’s on the verge of making the jump, this is a great link. Ben Kelly writes another great primer on how folks can capitalize on the 13 million businesses that will change hands in the next 10 years:

According to the Center for Entrepreneurship and Public Policy at George Mason University, the most productive companies in the United States are not the famous FAANG startups, but companies that were over 25 years old.

What does this tell us? It tells us that (time)x(cash flow)=success %

This leads us to the $10 Trillion tsunami.

I didn’t misspell that, that is trillion with a T.

Baby boomers are retiring at a rate of 11,000 a day and they own 45% of all the small businesses in the United States. There are around 30 million small businesses so that means that there is around 13 million businesses that need to exchange hands in the next decade.

That is around $10 Trillion in value that needs to be acquired. Let that sink in.

2. Great reminder for operators: “No amount of revenue is worth your team feeling unsafe or uncared for."

Stephen Olman (of Building 50 Companies by 2050) shared a moment of high friction with his customer this past week:

Last week, my business partner at one of our portcos (www.getquickerleads.com) was threatened by a client. Here’s the message that set things off:

“Sam, where the hell are all the campaigns? Sam, you removed all the campaigns did you? Think you are a smart cunt do you? You just committed business suicide! Watch your back Sam, I am coming after you and you have no idea the damage I can do to you and your family. You are a total fraud and your skills managing Google Ads are incompetent. You just made a fatal mistake destroying data that had nothing to do with you. Expect a knock on your door buddy. By the end of today I will know where you and your family live.”

Within 30 minutes of receiving this message, the client realized it was a mistake on their end. They were looking at the wrong account, but the damage was done.

His reflection:

The takeaway for me is clear: your partner(s) and your team are always the priority. Clients come and go, but it’s crucial that you have those priorities straight regardless of the financial circumstance or repercussion.

From “Building 50 Companies by 2050 - Issue #8”

3. Reflections from one searcher, 6 months post-acquisition:

I have been meaning to post for about 5 months, but my to-do list never seemed to let me. In December of 2021 I acquired Management Science & Innovation (MSI) after an 18-Month self-funded search. I am thoroughly enjoying my new role operating! The company is a boutique strategy and automation consulting firm with a history of both government and commercial clients.

A few quick takeaways from the search process: […]

Number 3: Have a defined prospecting process, scoped qualifying criteria, and a good story that creates credibility, value, and differentiation with the seller. It is a sales job. You are selling yourself and competing in an M&A marketplace that will often leave you outbid - understand how you will make up the difference in value.

From “Quick Insights Post Acquisition” on Searchfunder

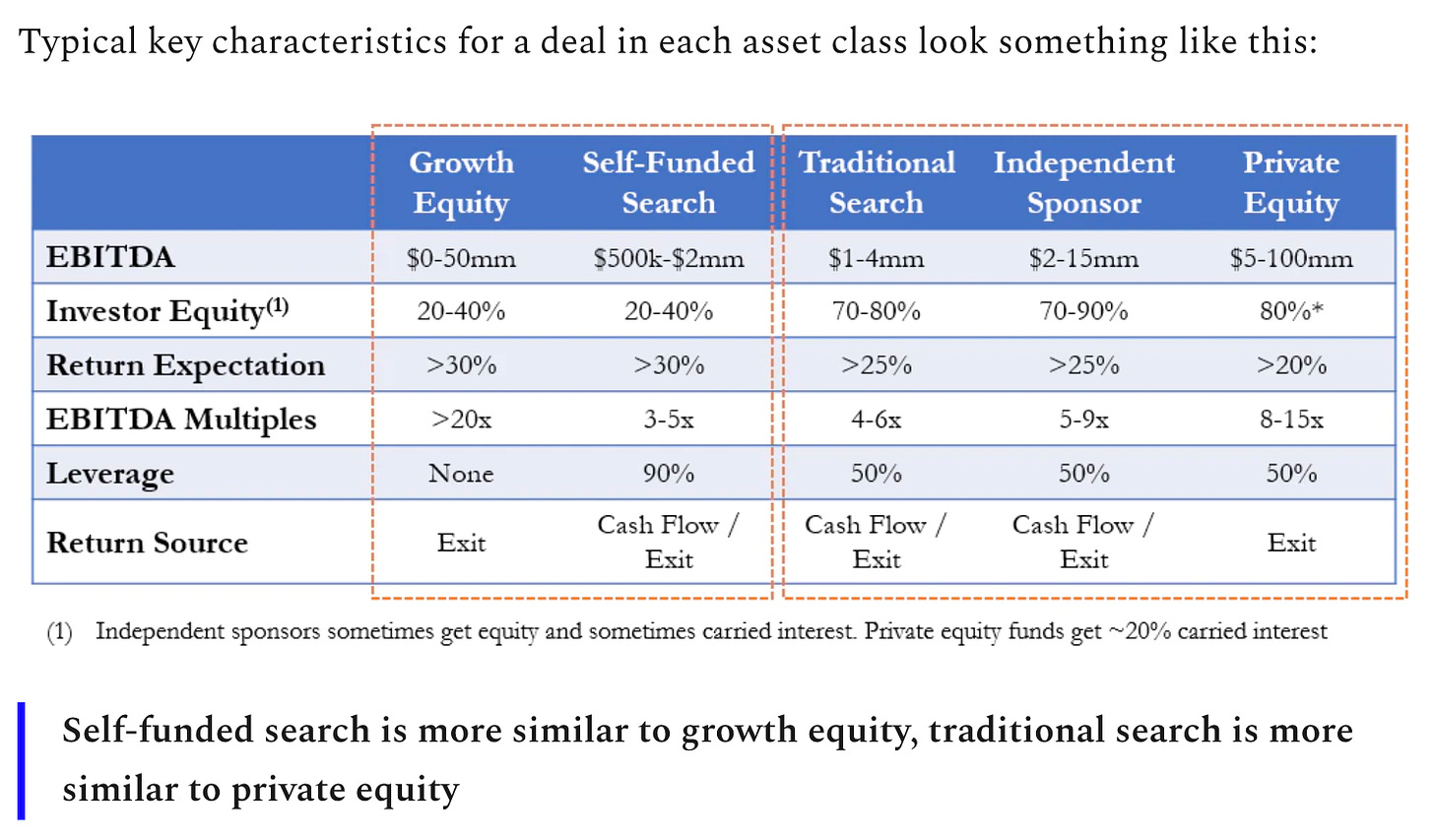

4. How to target the right investors:

More from the Buy Small Sell High Substack post linked at the bottom of his thread:

From “Understanding Search Funds as an Asset Class” on Buy Small Sell High

5. Get connected to other searchers via 1:1 virtual coffee chats on Friday, June 24th

Majority Search is hosting a 30 minute virtual coffee chat, where you can have a 1:1 conversation with another searcher/EtA/SMB person:

The goal with this event is simply to connect you with other like-minded community members who share your passion for EtA and small business building.

We’re opening these coffee chats to searchers, operators, investors and other SMB folks all across the USA, so we’d love for you to register regardless of your role or location.

While it might seem scary to match with a total stranger, this vibrant and growing EtA community is made up of incredibly talented and ambitious people and we think the potential to make meaningful connections is enormous (and far outweighs any potential downside or awkwardness)!

Sign up at Majority Search Coffee Chats.

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.