Take Five #015: The best question to ask a seller about their company & more

Five takeaways we loved at Kumo this week

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Before we jump into our Take Five: our beta for Kumo is LIVE! Try it for free:

What is Kumo?

Kumo is a powerful deal aggregator to help supercharge your deal sourcing.

What can you do with Kumo?

Browse 60,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily or weekly summary of deals that match your search criteria

Take Five #015: The best question to ask a seller about their company & more

1. The four types of holding companies (and why it matters):

A Holding Company is a business that owns other operating companies.Many people know the most famous HoldCo—Warren Buffett's Berkshire Hathaway.

But there are actually 4 types of holding companies. And they're each useful in different situations.

Here are the 4 types of HoldCos:

1) HoldCo (ex: Berkshire Hathaway)

2) Accumulator (ex: Dura Software )

3) Platform (ex: Roper)

4) Roll-up (ex: Waste Management)The main difference between each type of HoldCo is:

How alike are the businesses are you holding?

The more similar, the more you should centralize services or activities.

And get efficiencies/cost savings by doing so.

From Michael Girdley’s post on LinkedIn

2. Why acquisition is a long-term strategy

A great write-up and revisit of the compensation charts from HBR’s article “Which MBAs Make More: Consultants or Small-Business Owners?”, comparing salary:

Versus total compensation:

“Numbers aside, there’s an essential lesson in these payoff structures for aspiring entrepreneurs. We tend to focus on our short-term compensation opportunities – annual salary and bonus – but fail to sacrifice immediate income for better opportunities down the road. This concept of deferred gratification applies to many aspects of life but is particularly important for entrepreneurs to understand. One choice is not right or wrong, but generational wealth opportunities for yourself and your family will not occur without a long-term mindset and some willingness to take calculated risks. As an entrepreneur, you must be aware of that.”

From David LaMore’s “Economics of search funds”

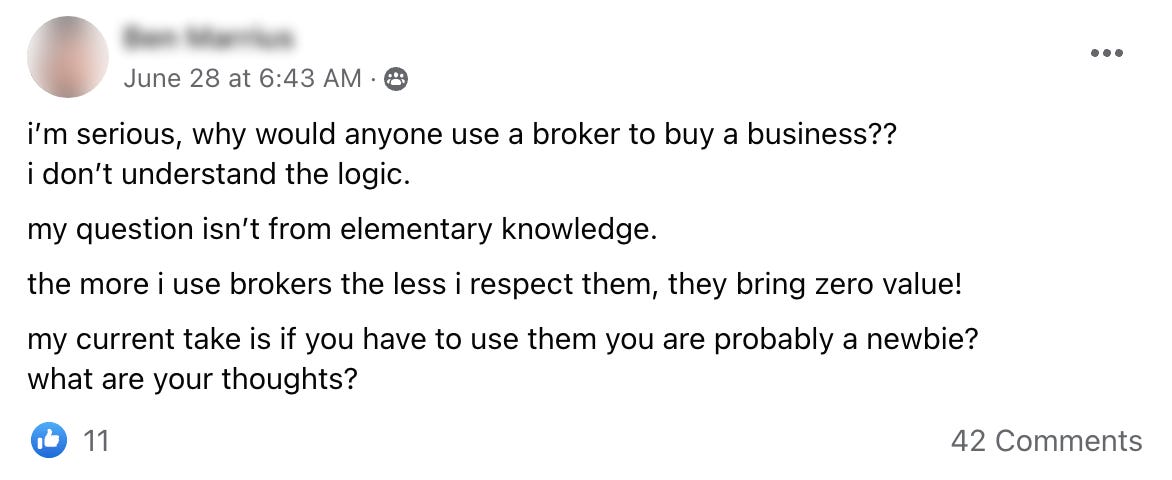

3. To use or not use a broker: that is the question

A heated exchange on the Buy Then Build Facebook group took off this week (42 comments!) on the merits of using brokers. The original post:

Interesting commentary and experience from both sides of the debate include:

“Brokers are the cushion and the filter between buyer and seller during what can be a highly emotional transaction with different and sometime abrasive personalities. My deal would have fallen apart several times without the broker's being able to talk the seller off of a cliff, explain things, and otherwise tell him to chill out and how things usually are. Now, the fee for selling can feel a little high if you were to compare to say.... real estate agents, but the service they provide is invaluable and can absolutely be the difference between closing and getting frustrated, lied to, defrauded, or giving up.”

Versus:

“There are good and bad like any profession. There are also a lot of terrible businesses and A LOT of terrible buyers that the brokers have to navigate through. I Have acquired through a broker and they were great. They brought a lot of value to both sides.

I’ve had poor experiences too.

I found it important to know how to communicate quickly and specifically. who I am and what Im looking for…with specifics. Industry, Rev, sde or ebitda, location. Ive had brokers come back later with things they think meet my parameters. And one was not marketed but presented to people matching the Sellers preferred profiles of a buyer. And I bought it.

I’d prefer off market, but I’d buy from brokers any day. Make friends not enemies.”

From the Buy Then Build Facebook Group post

4. The potential of asset-heavy rental companies (and why you might want to buy one):

5. The best question to ask a seller about their company:

An inquiring post on Searchfunder:

“What are the best questions to ask sellers about their company? Besides why they want to sell their company, what are good thought provoking questions to reveal solid information about their company?”

Lead to some great responses, like:

“There are 2 separate questions. 1. Why do you want to sell the company ? 2. Why do you want to sell the company now?

The first questions answer is that every company sells at some point. Even transferring between generations is effectively a sale. Death and divorce tend to be 2 triggers that force (everything else has less urgency and is voluntary)The second one is what you're really asking. And 99% of what you want to know is why NOW (Not the Why, the Why now). So what's the difference between this month and this month in 5 years time.

As someone who sold. And someone who bought a few companies, it varies as to what you want to reveal. But the more human you can make the discussion, the more you'll likely learn. Remember the seller won't precisely know. You're asking for a well thought through answer to how they feel. They may not fully know. The process creates a momentum they may find liberating or terrifying. They may have something they feel is embarrassing that they don't want to reveal. The most thought provoking questions are all around the timing. The why now.”

From “Seller Questions” on Searchfunder

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.