Take Five #018: How rate hikes and inflation have impacted acquisitions, & more

Five takeaways we loved at Kumo this week

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Before we jump into our Take Five: our beta for Kumo is LIVE! Try it for free now:

What is Kumo?

Kumo is a powerful deal aggregator to help supercharge your deal sourcing.

What can you do with Kumo?

Browse 100,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily or weekly summary of deals that match your search criteria

Take Five #018: How rate hikes and inflation have impacted acquisitions, & more

1. Starting a search fund? Five critical areas to work on in preparation:

We always share David LaMore’s content as great advice from one (successful) searcher to another.

Here’s his answer to the question: “How should you go about the months leading up to your search?”

“Today, I’ll take a closer look at the months leading up to raising search capital to help those who might be 4-6 months out. I’ll provide five areas to work through in your preparation that helped me close fundraising in one month: experience, focus, networking, differentiation, and action. I cannot thank enough the countless searchers I had the opportunity to talk with last summer as I got ready to fundraise. These insights come primarily from those conversations.

In this post, I assume you are already up to speed on ETA-related coursework, have a good idea of whether you’ll go partnered or solo, and strongly prefer a particular search model. If not, no worries – please refer to the Educating yourself on ETA post and this A.J. Wasserstein article if you’d like a high-level view of planning for a search fund during your MBA. For those not attending business school, who are pursuing a search well after your MBA, or who didn’t take a course in Entrepreneurship Through Acquisition, these tips should still be of value to you.”

From “Building a plan to launch” by David LaMore

2. What Got You Here Won't Necessarily Get You There

One roll-up CEO’s experience on pushing past “Sustain mode” into “Growth mode”:

“We are about to acquire our 3rd business two weeks from now, and all were profitable, successful, and growing before we ever got involved. That said, there’s sometimes a sense that we just need to do more of the same to keep profitably growing. I mean on the surface, it makes sense. If I’ve done something one way, and gotten good results, let’s just keep going right?

I’ve tried to explain that if each business grows another 2 or 3x, and we are rolling everything into a platform company, things are necessarily going to have to look, feel, and operate differently than they do today. This is a hard message to convey and requires repeating and sharing from multiple angles. Below are just a few of those areas we see in our businesses, perhaps you can see parallels in yours as well.”

And his follow up story on how this plays out in real life with his own company:

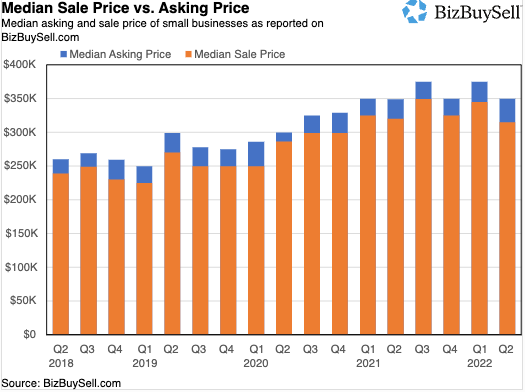

3. The BizBuySell Q2 Insight Report is in:

Their byline: “Small Business Acquisitions Slow Slightly in Q2 Amid Rate Hikes and Inflation.” Read the full report here:

Despite the dip in Q2 transactions from the first quarter, the market rebound remains intact with acquisitions up 58% since activity stalled in 2020. That said, current economic conditions are likely to present a short-term speed bump in the road to complete recovery. This is particularly true for buyers having to navigate more expensive financing.

Forty-nine percent (49%) of surveyed buyers said they are delaying their purchase due to Federal Reserve Rate hikes. At the same time, continued record traffic to BizBuySell indicates demand remains, so, it's likely buyers are pausing to recalibrate what they can afford. "Rates pretty much only had room to go up, so the increase doesn't change my desire to buy a business though it does change the menu of options available," said a buyer who wished to remain anonymous.

While some are looking at lower priced businesses, others anticipate owners dropping prices instead. Twenty-four percent (24%) of buyers expect a lower price today compared to a year ago. This is an optimistic minority compared to the 41% still expecting to pay more and 35% seeing values remain the same.

From the BizBuySell Insight Report

4. “Don’t start a tech startup”: a pitch for EtA in /r/fatFIRE:

Interesting to see a full pitch for Entrepreneurship through Acquisition on /r/fatFIRE. (/r/fatFIRE/ is a subreddit for those interested in Financial Independence, Retiring Early, but with a substantially higher standard of living):

“A strategy I have applied is to acquire B2B service businesses. 2 acquisitions done and 2 in the pipeline. Each business has been founder operated and founders have been in the 60-70 years age bracket. The businesses I’ve acquired and the ones I’m working on now, have steady 15-20% EBITDA margins and have bankable revenue for the past 6-7 years. No growth, just steady recurring revenue, but they haven’t changed in 20 years.

My strategy is to acquire these boring service businesses for 3-5 x EBITDA and transform them by adding a layer of technology to the company. Something as simple as a customer facing application that changes how your customers engage and interact with the service offering can dramatically increase the ability to win business, retain customers, automate business process etc.

Following this strategy, we have been named as “disruptors” in our little corner of the world, but we have not created anything life changing by a long stretch, just designed a better mouse trap. It’s easy to be the best in a sleepy industry.

Has anyone else followed a similar strategy?”

Nothing new to anyone who’s been searching to acquire for any time at all, but the comments debating the merits to his post are fun.

From “Don’t start a tech startup” post on /r/fatFIRE

5. Double SMB Attorney feature: the new SMB Law Group is live (and doxxed!)

Well beloved by SMB Twitter, SMB_Attorney has finally launched his own law group AND revealed his face.

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.