Take Five #021: “What's the BEST tip you've learned about buying companies?”

Five takeaways we loved at Kumo this week

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Before we jump into our Take Five: our beta for Kumo is LIVE! Try it for free now:

What is Kumo?

Kumo is a powerful deal aggregator to help supercharge your deal sourcing.

What can you do with Kumo?

Browse 100,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily or weekly summary of deals that match your search criteria

Take Five #021: “What's the BEST tip you've learned about buying companies?”

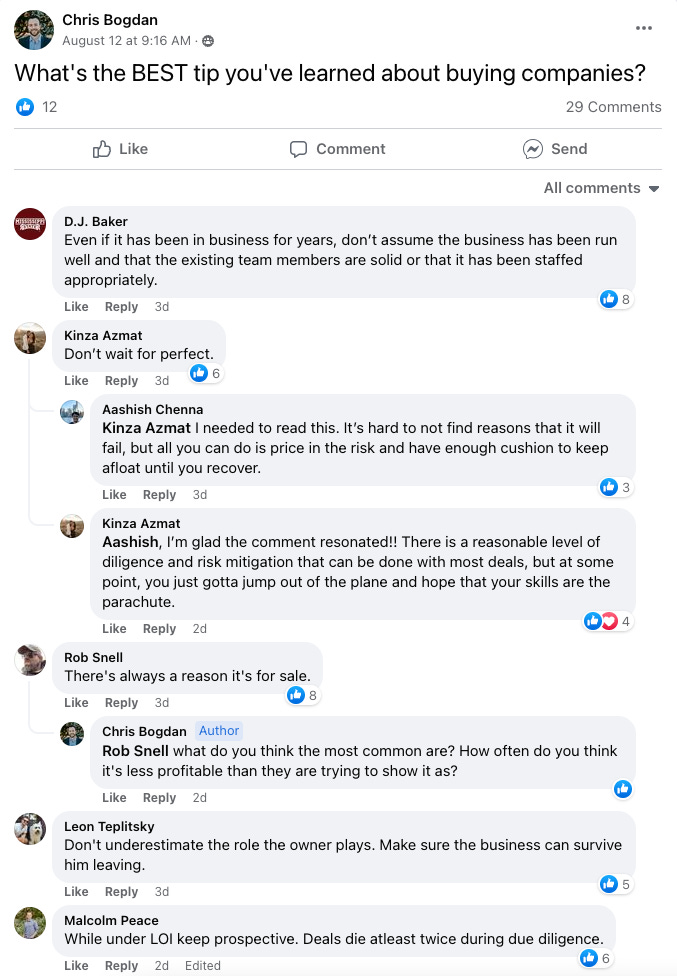

1. “What's the BEST tip you've learned about buying companies?”

From one of the top posts this week in the Buy then Build Facebook Group (a group with 6k members!):

More comments in there, including a long thread about operating experience.

From “What's the BEST tip you've learned about buying companies?” by Chris Bogdan on the Buy then Build FB group.

2. How to get on the same page with the seller about large hairy details

Great thread from the ever-helpful @SMB_Attorney covering

Why do you really need an LOI?

Transaction Description

Purchase Price

Reps, Warranties, and Indemnification

Conditions to Closing

Exclusivity and No-Shop

Non-binding Effect of the LOI

3. How not to buy a bad deal

At the tail end of last week, we finalized our sale of Sentiment Investor (SI). It's in much better hands now with a team that can execute on the vision. SI was a tough one for us. We had a bad transition when we bought it, lost 100% of the customer base in that process and then rewrote it, and effectively shelved it. It was a delight working with the group that bought it from us and I have full confidence they're going to make much better use of it than we did. […]

Sometimes, all you can do is hope for some kind of ending. I'm so glad we found SI a new and great home. It was a bad buy with a lot of hard lessons learned. Frankly, I don't know how I'd learn some of this stuff without going through it myself. Supposedly people can learn from the mistakes of others by reading about them. I think that's a tall order for real world stuff.

His full post-mortem includes notes on:

Red Flags In Diligence

Hold Money Back - Do not wire it all upfront

Customer Diligence

Product

Product-Market Fit

From “How Not To Buy A Bad Deal & Our 2nd Sale!” from XO Capital

4. Once you’ve acquired a new company: get ready for it to get emotional

Great thread by Steve Ressler on the 1 month, 1 quarter (3 month), 1/2 year, and 1 year path towards integrating an existing team into the fold:

5. The nitty gritty on what it takes to own and operate a car wash, from one honest owner:

tl;dr on the full thread:

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.