Take Five #022: A business with 87% EBITDA profit margin, and more

Five takeaways we loved at Kumo this week

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Before we jump into our Take Five: our beta for Kumo is LIVE! Try it for free now:

What is Kumo?

Kumo is a powerful deal aggregator to help supercharge your deal sourcing.

What can you do with Kumo?

Browse 100,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily or weekly summary of deals that match your search criteria

Take Five #022: A business with 87% EBITDA profit margin, and more

1. How to structure your SMB purchase:

Fact: we’ll never stop sharing great tweet threads from @SMB_Attorney.

2. Crucial principles to ponder when sourcing SMB deals:

Some guiding thoughts on questions to ask yourself when sourcing quality deals in the SMB space:

When it comes to looking for deals, the most important step is to understand what you actually want to buy. It’s easy to pull out the size of business you want and the location, but it’s harder to narrow down the criteria of a business you like and even a specific industry. Before starting a direct sourcing approach, it’s important to answer these questions (as well as many more):

Do I want to buy a B2B business or a B2C businesses?

What industry do I like? Why do I like it?

Why am I a good owner for this type of business? What sets me apart?

How would I think about improving a business in this industry over 5-10 years?

From “Sourcing SMB Deals” by Andy Vandenberg

3. A 10,000 foot view of SBA loans for the uninitiated

Sieva Kozinsky’s most recent newsletter does a great high level overview of SBA loans and how you might use them as “high leverage opportunities for US Citizens to build wealth relative to their means”:

SBA 7(a) allows you to buy a business with up to $5 Million of debt and only put in 5-10% of the purchase price down as cash. You also get 10 years to pay it back with monthly payments, and a reasonable interest rate.

That’s pretty cool right? With a relatively small cash investment, a personal guarantee (more below) and a good business at a good price, you can become a business owner.

First, let’s think about why the US Government wants to help people buy small businesses (SMBs). SMBs employ 50% of the US working population!

Normal banks won’t loan to SMBs because they’re too small and too risky.

But we also don’t want a small business owner to “close shop” and lay people off when it’s time to retire.

So the government invented the SBA 7(a) loan.

The government uses it to encourage lenders to lend to small businesses. They do this by guaranteeing to pay back the lender 90% of the capital if a business fails. That’s a pretty great deal for the lender! And thus encourages a lot of SBA loans to get written.

He also handily linked to “Top SBA lenders by volume” as part of the post: “Some lenders are very conservative and hard to work with. I suggest connecting with the most active lenders.”

From “Sieva’s 3 Favorite Tweets” by Sieva Kozinsky

4. “Why is the Searchfund model so attractive to so many people?”

An anonymous user asked on Searchfunder:

“Why is the Searchfund model so attractive to so many people?

I wanted to know so many people choose to work with the Searchfund model. What about it is so attractive to so many people. What are some alternative that you guys might prefer? Would love to hear your thoughts!”

Searchfunder founder Luke Tatone responded with a great roundup of past posts by other searchfunders detailing their own personal “whys”:

Anonymous - there are several older posts that address the "Why" question. You can find older posts by using the search bar and filtering by "posts." Here are a few that might be helpful. Sorry for the wall of text!

www.searchfunder.com/post/why-more-mbas-should-buy-small-businesses

www.searchfunder.com/post/why-i-like-working-with-young-ceos-1

www.searchfunder.com/post/why-a-search-fund-for-you-operations-equity

www.searchfunder.com/post/question-for-all-the-searchers-why-you-want-to-go-the-search-fund

www.searchfunder.com/post/considering-search-a-reflection-on-4-years-in-the-trenches

From “Why is the Searchfund model so attractive to so many people?” on Searchfunder

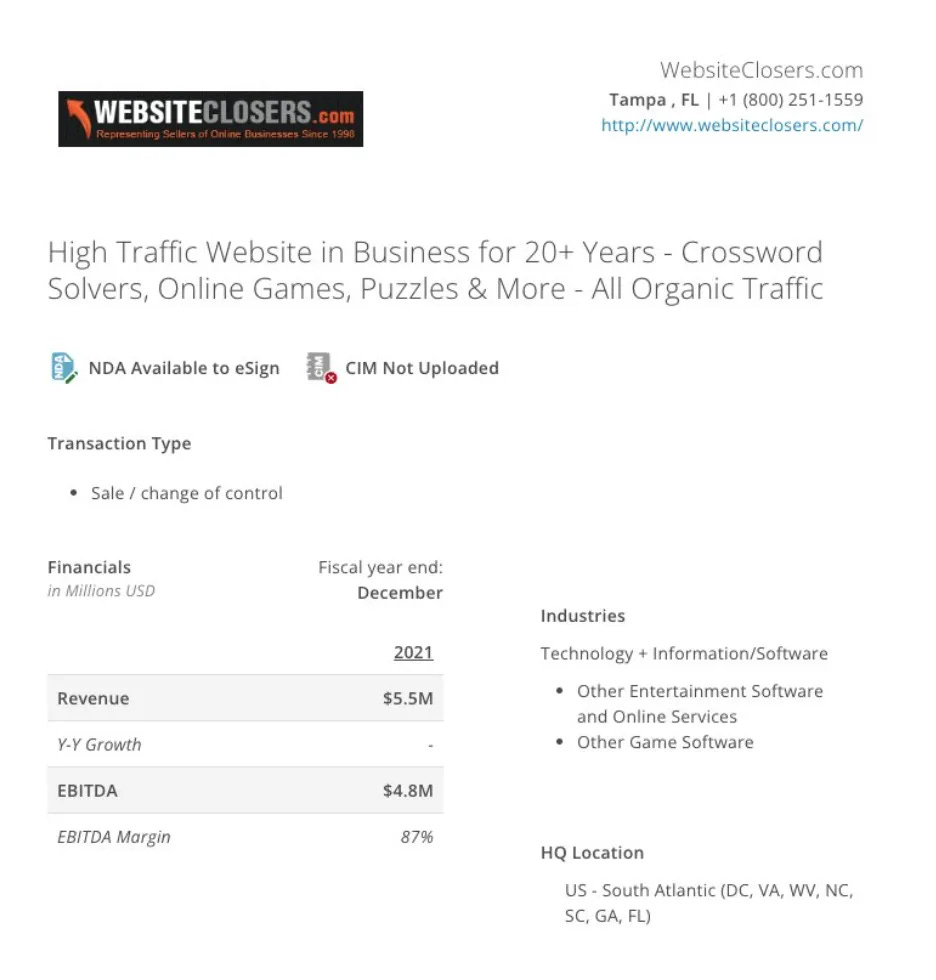

5. “87% EBITDA profit margin?!” An Incredible Money-Printing Crossword Business

Great breakdown of a niche website deal (an online puzzle site) by Michael Girdley, and why it may or may not be a great buy:

As I’ve spoken about this deal with my friends, three themes came up:

1) This broker doesn’t have the best reputation.

They said to be sure to double-check everything they’re claiming. There may be some dirt under the covers. Or numbers that just aren’t true.

2) Display ads are fragile, so you’re betting the ad rates stay healthy.

They crashed when the economy slowed in past recessions. “There are easier ways to make money than paying top dollar for this,” one said.

3) The Google-dependent nature of this business makes it unsellable.

The seller will likely want 4-7x EBITDA because they’re making $4.8mm a year owning it.

All from a <$10k investment!

But a buyer can only afford that price if the future is predictable.

So, we have a business that likely won’t ever sell.

But I wish I owned!

From “For Sale: An Incredible Money Printing Crossword Business” by Michael Girdley

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.