Take Five #045: How one PE pro evaluates deals with some simple back-of-the-napkin math, and more

Top five must-reads this week in the world of SMB acquisitions and operations

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates hundreds of thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Take Five is created and sponsored by Kumo, a powerful deal aggregator to help supercharge your deal sourcing at withkumo.com.

What can you do with Kumo?

Browse 120,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily email for deals that match your search criteria

Take Five #045: How one PE pro evaluates deals with some simple back-of-the-napkin math, and more

1. Mastering the art (and science) of good deal judgement

Great 10 point thread by Steve Ressler of the Brydon Group on why you need to learn how to assess deals: “In the end, deal judgment is a combination of art and science. It's about being able to balance risk and reward, intuition and analysis, and short-term gain and long-term success.”

2. In the same vein: how one PE professional assesses their deals with some simple questions

“Overall, good deals can be assessed on a napkin or simple bridge. No need to over complicate the model.”

3. Visionary? Integrator? Maybe it doesn’t matter

If you use EOS to run your business, you may be familiar with Visionary and Integrator labels as a way to structure business roles & accountability. Here’s an excellent thread by Josh Schultz of CaneKast on how why he drops those labels and how he builds/partners with others in real life:

4. 5 crucial questions to get you started on your due diligence

5. The 12 Basics of LOIs you should know

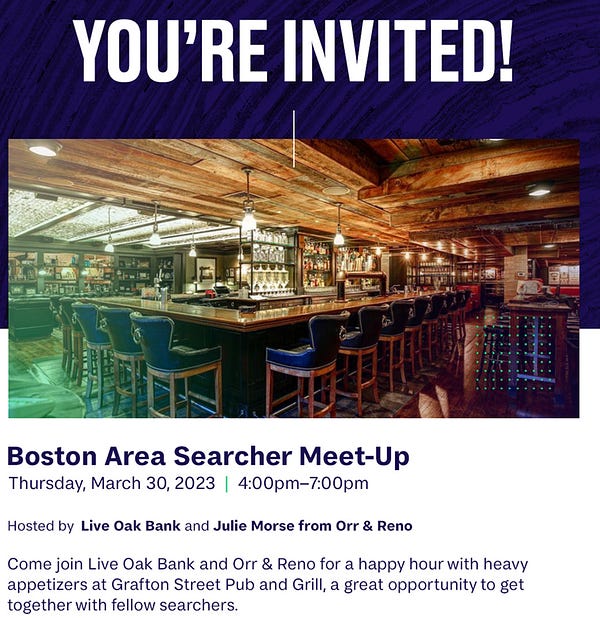

Upcoming Events in the SMB & Business Acquisition Space

(A ✨new✨ section in our newsletter: we’ll be adding to this list weekly, so send over any events you think we’ve missed!)

March 23, 2023: The Wharton ETA Summit 2023 is hosted on 3/23 in Philadelphia, PA (link here).

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.