Take Five #065: Pricing strategies, top tactics, and more

Top five must-reads this week in the world of SMB acquisitions and operations

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates hundreds of thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Take Five is created and sponsored by Kumo, a powerful deal aggregator to help supercharge your deal sourcing at withkumo.com.

What can you do with Kumo?

Browse 120,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily email for deals that match your search criteria

Take Five #065: Pricing strategies, top tactics, and more

1. How experience in corporate culture helps on the ETA path (and how it can hold you back)

To be clear, there are PE skills that have proven useful in the SMB operating context, largely around KPI tracking, budgeting, financing decisions, etc. The skills that transferred best are tactical in nature.

By contrast, I’m finding myself actively fighting my instincts on the strategic & people management side of operations, which is far more important on a longer time scale.

It’s worth calling out that dynamic for searchers coming into SMB from that world (and my guess is searchers with large corporate backgrounds would face similar transition issues coming into SMB, though I have no direct experience there).

Read the full article here.

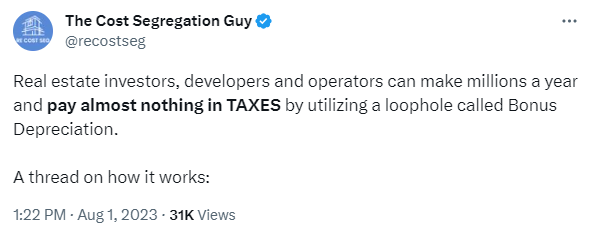

2. 💥 Tax Loophole: How to make Bonus Depreciation work for you

3. “Ask better questions, get better answers”

Entrepreneur-influencer Shaan Puri offers up tips and scripts that can lead to better conversations, efficiency, and results in business (and life in general).

4. A comprehensive pricing guide with strategies, considerations, and top tactics

5. M&A = more stability and profitability vs. starting from scratch in this niche industry

“There are five big companies that do ten times what we do. There are maybe 40 mom-and-pops. Then, there are maybe three or four other mid-level growth companies like ours. So, for us, it feels like there’s a lot of opportunity,” Xander explains.

That opportunity meant not only capturing new markets but improving the quality of care for the worker community. But growing organically was proving challenging, largely because hiring enough home health workers required massive outlays of time and resources. In March 2020, Xander went looking for help and found Hayden Brink, Trusted Ally’s now-Director of Finance. In an initial meeting, Hayden pitched Xander some ideas for the agency’s expansion. M&A was at the top of that list, given his early career experience in sell-side investment banking.

“I certainly think that in terms of being able to grow revenue 20 to 30% in one hit, it’s a lot faster to do an acquisition than it is to build organically,” Hayden says, “and the ROI can still be there.”

Read the rest of the article here.

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.