Take Five #076: How to create a business plan you'll actually use, and more

Top five must-reads this week in the world of SMB acquisitions and operations

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates hundreds of thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Take Five is created and sponsored by Kumo, a powerful deal aggregator to help supercharge your deal sourcing at withkumo.com.

What can you do with Kumo?

Browse 120,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily email for deals that match your search criteria

Take Five #076: How to create a business plan you'll actually use, and more

1. Compelling conversation about investing, finding profitable product niches, and business-life philosophies

Serial entrepreneur Jesse Itzler discusses successes and strategies, his underdog mentality, a few business ideas, plus ideologies on money, relationships, and more.

2. Difference between Net Income (NI) and Free Cash Flow (FCF)

Cash flow is the lifeblood of any SMB. But you need to track both Net Income (NI) and Free Cash Flow (FCF) in order to fully understand your business.

This also includes understanding when these two measures differ and why.

So this week, I’m talking all about Net Income vs. FCF:

What they are

What they mean

How they’re calculated

And when they differ

Find the rest of The Finance of Scale’s article here.

3. Example of a well-oiled KPI system

4. Interview: Mechanics of operating a search fund

The landscape is ripe with opportunities for entrepreneurial individuals to acquire businesses. Innovative models are emerging within the ETA community, such as long-term holding companies, catering to those seeking to retain ownership over extended periods beyond the conventional 5 to 10-year timeframe.

Further, growth-focused acquisitions, less dependent on debt for transactions, are on the rise, outpacing historical trends. This acceleration fuels greater creativity and diversity in deal structures, enriching the ETA ecosystem.

Read David LaMore’s interview with Jack Wong here.

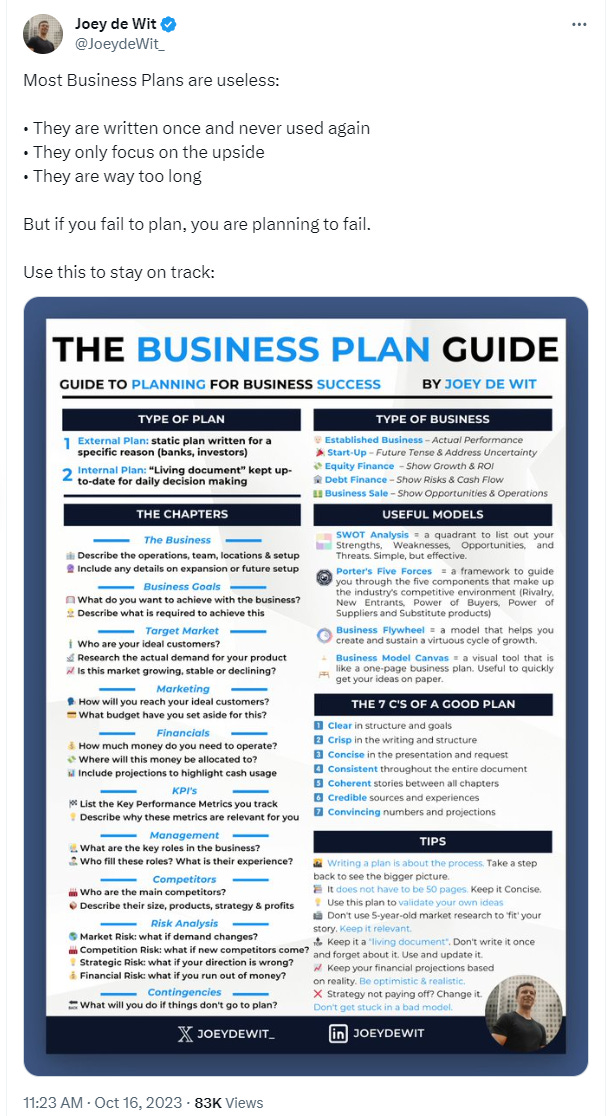

5. How to create a business plan you'll actually use

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.