Take Five #115: New financials vetting method that saves time and money during QofE, and more

Top five must-reads this week in the world of SMB acquisitions and operations

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates hundreds of thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Take Five is created and sponsored by Kumo, a powerful deal aggregator to help supercharge your deal sourcing at withkumo.com.

What can you do with Kumo?

Browse 120,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily email for deals that match your search criteria

Take Five #115: New financials vetting method that saves time and money during QofE, and more

1. Some solid insights on buying and operating a business remotely

2. HoldCo-building timeline, from days to decades

The worst thing that can happen in life:

Getting old and realizing you got good at the wrong thing.

Therefore, when setting 10, 20, 30 year goals, it is very important to let your mind wander.

Whether it's building a private equity firm…

Or a holding company for profitable niche companies…

That said:

Every time you start building a business you should ask, what would XYZ do?

For example, when it comes to acquiring and growing traditional niche businesses, ask, for example - what would young Henry Kravis and George Roberts from KKR do?

So here's how I think they'd manage their time when building a holding company for traditional $2-10 million companies.

At least that's how I would do it.

Dream in Decades -> Think in Years -> Work in Weeks -> Live in Days

Read the rest of PrivatEquityGuy’s post here.

3. Redditors weigh in on what “execution” looks like in business

4. How to calculate how much equity a searcher gets to keep (includes a link to an editable spreadsheet template)

How much equity can I get?

Variations on this question are “what kind of step-up should I ask for?” or “how much carry can I get” or “how much sweat equity should I ask for?”…there are a dozen different ways to ask the same question.

But how much equity you can get is an ANSWER — not the question you should be asking. It’s the answer to how much Equity IRR your deal can generate, and how that IRR gets shared around investors and you. I’ll define IRR and Equity IRR in a moment, but let’s set a core foundation first.

There are three fundamental ways to generate Equity IRR:

Reducing the Amount of Equity Capital by Adding Debt Capital (aka Leverage)

Growing the Business (aka Increasing Cash Flow)

Reducing Cost of Capital (aka Increasing the Business Valuation Multiple)

That’s it — just about any deal can be boiled down to those three levers.

So how does that help you answer How Much Equity Can I Get?

The list above can be turned into a series of preceding questions — I’ll walk you through each one below, with a link to a Google Sheet at the end to let you play with various scenarios.

Read Big Deal Small Business’s post here.

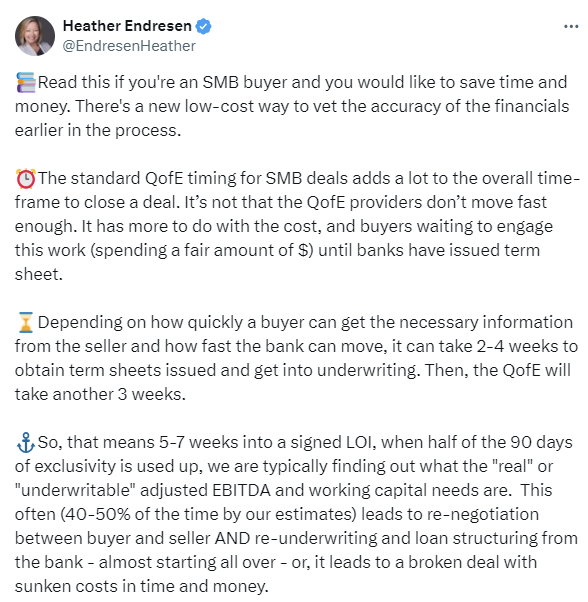

5. New financials vetting method that saves time and money during QofE

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.