Take Five #122: How franchise bolt-ons can complement core business offerings and accelerate growth, and more

Top five must-reads this week in the world of SMB acquisitions and operations

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates hundreds of thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Take Five is created and sponsored by Kumo, a powerful deal aggregator to help supercharge your deal sourcing at withkumo.com.

What can you do with Kumo?

Browse 120,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily email for deals that match your search criteria

Take Five #122: How franchise bolt-ons can complement core business offerings and accelerate growth, and more

1. Some business valuation insights, methods, and variables to consider

If you’ve followed the previous steps you have a confident and accurate assessment of SDE, you’ve spent time researching market multiples for this industry, and compared to the target business characteristics to determine a fair price if the business has been represented accurately.

Adjustments to the multiple valuation can be made for many reasons:

These include unexplained increases in revenue or profits near or after the decision to sell

a general manager or operator unwilling to stay with the business after sale

poorly maintained equipment

loss or expiration of major contracts before the close of sale

a landlord unwilling to renew the lease with favorable terms

stock that is out-of-date or unsellable, requiring write-offs and loss of potential revenue

The seller stops operating the business in a normal and profitable way once under contract, causing irreparable damage to the company and brand prior to closing

Don’t let negative findings make you emotional - know when to adjust the price and when to simply walk away from a deal that can’t be saved.

After all, paying the RIGHT price sets the foundation for a profitable future.

It’s easy to get caught up in trying to “make a deal work” when the numbers don’t align and the risk has gone past your threshold thereby decreasing the overall value - Stick to the process.

Read Sage Price’s post here.

2. A detailed overview of SMB owner tax benefits

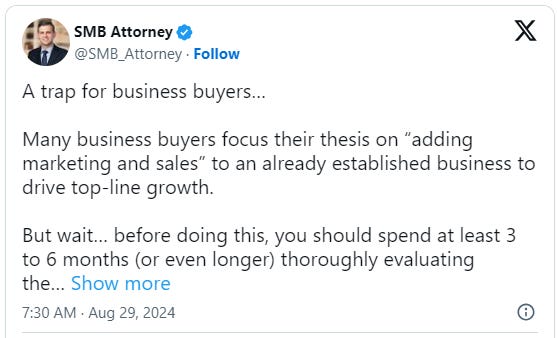

3. Resisting the urge to prioritize sales growth immediately after business acquisition

4. 💡 How franchise bolt-ons can complement core business offerings and accelerate growth

5. A durability framework for long-term SMB growth and stability

Running a small business is a different game — more like a marathon than a sprint. While the sprint toward rapid growth is one way to succeed, small business success is built on endurance, strategy, and the commitment to creating something that lasts.

Durability is the name of the game. These businesses don’t always grab attention. They don’t get the viral moments or the billion-dollar valuations. Instead, they focus on the craft of building something that gets stronger every day.

They’re the manufacturing plants that start production before the sun rises, the local repair shops that know their customers by name, the family-owned stores that have been part of the neighborhood for generations.

In a world obsessed with rapid growth, these businesses understand something crucial: the value of durability. I call this the quiet strength of small business.

Find the rest of the Local Legends post here.

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.