Take Five #147: Seller equity rollovers in asset purchase with an SBA loan, including how it works, who benefits, and more

Top five must-reads this week in the world of SMB acquisitions and operations

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates hundreds of thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Take Five is created and sponsored by Kumo, a powerful deal aggregator to help supercharge your deal sourcing at withkumo.com.

What can you do with Kumo?

Browse 120,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily email for deals that match your search criteria

Take Five #147: Seller equity rollovers in asset purchase with an SBA loan, including how it works, who benefits, and more

1. Seller equity rollovers in asset purchase with an SBA loan, including how it works, who benefits

2. Top types of revenue streams explained, ranked from best to worst

The Best: Contracted & Predictable Revenue

1. Multi-Year Recurring Contracts (The Ultimate Stability)

Example: An MSP (Managed Service Provider) signs a 3-year IT support contract with a law firm, guaranteeing monthly payments regardless of service usage. My company DataTel typically does 3-5 year contracts with our clients, which means I have reliability and stability years into the future. This is one of the more compelling reasons why I thought it was an incredible business when I acquired it.

Why It’s Great: Predictable cash flow, high customer retention, and strong business valuation.

2. Annual Recurring Revenue (ARR) (Locked In for the Year)

Example: A cybersecurity company sells annual software licenses for endpoint protection, ensuring renewal revenue every year.

Why It’s Great: Clients commit for a full year, minimizing churn and maximizing upfront payments.

3. Monthly Recurring Revenue (MRR) (Steady, Monthly Growth)

Example: A VoIP provider charges businesses a monthly fee per phone line, creating a continuous revenue stream.

Why It’s Great: Steady cash flow with monthly billing, though clients could cancel at any time.

Read the rest of Ben Tiggelaar’s post here.

3. Lender outlines how SBA 7a + SBA 504 CRE = Up to $8M in funds

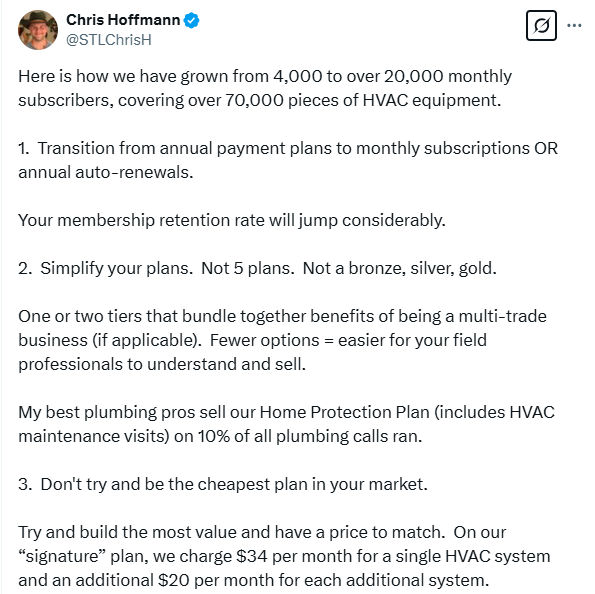

4. HVAC company grows from 4K to 20K monthly subscribers: owner shares strategy, tips

5. “Behind Every Great Searcher: A Wife's Journey with Search”

First we hear from Cliff Nelson, who bought a business with over $15m in revenue and about 125 people. The business provides mental health services to nursing homes & facilities.

Cliff and I get into all the usual good detail about his search and the business he bought.

You will get a window into acquiring, leading, and growing a business that is people intensive, a common feature in healthcare businesses.

But you'll also get a window into Cliff's home life as he went through this journey. His wife was pregnant contemporaneous with his search, and gave birth to their first child within a week of Cliff closing on the business.

This was a trial for the family, to say the least.

And then we'll hear about that trial in more depth from Christine, Cliff's wife.

Christine and I have our own, separate conversation, in order to give you another perspective on this journey.

You will hear how intertwined the search is with Christine and Cliff's personal life, with their marriage, with the birth of their first child.

And it is a keen reminder that while the searcher is so often the protagonist in these stories, the spouse or romantic partner is very much on this journey themselves.

Find the full Acquiring Minds episode here.

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.