Take Five #156: SBA loan cushion rescues buyer after seller’s deal fatigue costs business its top customers, and more

Top five must-reads this week in the world of SMB acquisitions and operations

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates hundreds of thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Take Five is created and sponsored by Kumo, a powerful deal aggregator to help supercharge your deal sourcing at withkumo.com.

What can you do with Kumo?

Browse 120,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily email for deals that match your search criteria.

Take Five #156: SBA loan cushion rescues buyer after seller’s deal fatigue costs business its top customers, and more

1. Lender rehashes searcher’s $27k lesson, including a $360k add-back oversight that ultimately killed the deal

2. Semi-deep dive into how to develop an AI-assisted finance department

Use AI-Powered Transactional Software

High-volume, repetitive processes (like Accounts Payable or expense approvals) benefit hugely from AI-enhanced software. Here’s how we did it at OpenAI:

Choose Smart Software: We adopted expense management software with built-in AI. It automated compliance checks, caught errors, and learned continuously. This immediately freed up time for strategic tasks.

Real-Time Compliance: AI tools flagged policy violations instantly, greatly reducing the manual workload and human error.

Encourage Continuous Improvement: AI-driven software gets smarter through feedback. Regular team input significantly improved software accuracy and reduced corrections over time.

Read the rest of OnlyCFO’s post here.

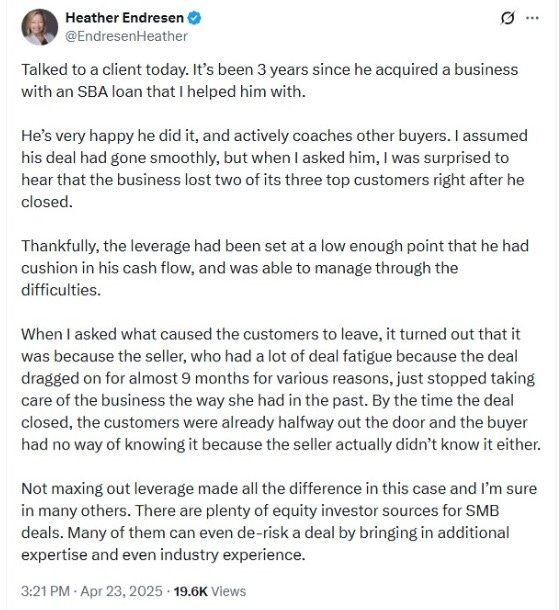

3. SBA loan cushion rescues buyer after seller’s deal fatigue costs business its top customers

4. Risk Ratio Index: Calibrated risk is where the gains typically exist

5. Podcast: “Why Networks are Your MOAT and Competitive Edge (And How to Build Them?)”

In this HoldCo Builders episode, host Mikk Marcus aka PrivatEquityGuy zeros in on how to build a powerful, compounding network through the lens of investor Alix Pasquet’s insights. From using the “Triad” strategy to becoming valuable to the right people, the episode explores how networks serve as both a competitive edge and a safety net in business and investing. Packed with actionable tips on generosity, persistence, and long-term thinking, it’s a must-listen for anyone looking to grow meaningful connections that truly matter.

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.