Take Five #159: 10 ways to translate a CIM, and more

Top five must-reads this week in the world of SMB acquisitions and operations

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates hundreds of thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Take Five is created and sponsored by Kumo, a powerful deal aggregator to help supercharge your deal sourcing at withkumo.com.

What can you do with Kumo?

Browse 120,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily email for deals that match your search criteria.

Take Five #159: 10 ways to translate a CIM, and more

1. 💥 Event: ETA Deal Team Day NYC | June 4, 2025

This one-day event for active searchers covers it all: actionable strategies, networking opportunities, 1:1 chats with industry experts, and a solid lineup of speakers, including Kumo CEO Jason Pratts, SMB Law Group’s Laura Gieseke, and System Six’s Tim Wear.

Still time to register! Find ETA Deal Team Day NYC details and ticket info here.

2. What to consider when structuring business partnerships so there’s an out if the relationship goes south

3. 10 ways to translate a CIM

A Confidential Information Memorandum (CIM) is a key document in SMB acquisitions. It provides a detailed overview of a business, including financials, operations, and growth potential. But reading a CIM isn’t enough - you need to analyze it effectively to uncover actionable insights. Here's how:

10 Key Strategies:

Go Beyond EBITDA: Analyze liquidity, profitability, and leverage metrics for a complete financial picture.

Check Customer Risk: Identify revenue concentration risks and assess customer health.

Understand Working Capital: Review cash flow, inventory turnover, and payment terms.

Validate Market Growth: Use top-down and bottom-up methods to confirm market size and growth claims.

Review Capital Spending: Assess how efficiently the business invests in growth.

Measure Staff Metrics: Evaluate revenue per employee, retention rates, and productivity.

Calculate Customer Acquisition Costs (CAC): Break down marketing and sales expenses to assess profitability.

Spot Cost-Saving Opportunities: Identify inefficiencies in operations, contracts, and processes.

Scrutinize Financial Projections: Verify forecasts against historical performance and market trends.

Craft a Data-Driven Offer: Use financial and operational insights to structure a fair, strategic offer.

4. Owners, operators, CPAs discuss experiences, give advice on making the Enterprise Resource Planning leap (in the🧵)

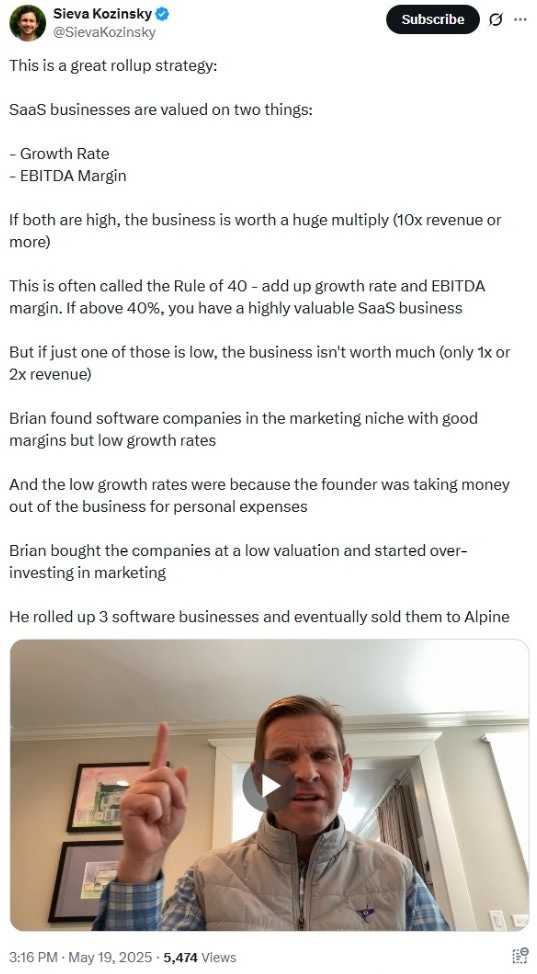

5. High margin + low growth = SaaS roll-up opportunity

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.