Take Five #166: Earnout Payments 101: Key clauses, performance metrics, tax impacts, and dispute safeguards explained, and more

Top five must-reads this week in the world of SMB acquisitions and operations

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates hundreds of thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Take Five is created and sponsored by Kumo, a powerful deal aggregator to help supercharge your deal sourcing at withkumo.com.

What can you do with Kumo?

Browse 120,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily email for deals that match your search criteria.

Take Five #166: Earnout Payments 101: Key clauses, performance metrics, tax impacts, and dispute safeguards explained, and more

1. “From Buckles to Business: How Revolutionary War Veterans Built America and How Today’s Veterans Carry the Torch”

Legacy Continues: Veteran ETA Today

Fast forward to 2025. The message is clear: ownership is legacy.

Today’s veterans bring discipline, mission focus, and resilience to business. In ETA, they’re not just buying companies—they’re reviving Main Street, creating jobs, and shaping communities.

When a veteran buys a plumbing materials manufacturing company, it’s the modern echo of Revere’s foundry. When they purchase a logistics firm in rural America, it mirrors Washington’s frontier stewardship. These moves build economic independence—for families and towns.

ETA: A Living Inheritance

ETA isn’t just a program—it’s a purpose-driven mission rooted in that early veteran spirit. Here’s how:

Continuity: Like Revere expanding his silversmith shop, veterans today scale legacy businesses to thrive long-term.

Community Impact: Washington’s distillery fed local economies; today’s veteran-owned businesses serve as hubs of growth and pride.

Resilience: Just as Forten weathered early capitalism’s volatility, modern veterans bring strategic adaptation to surviving market shifts.

Legacy Mindset: These businesses aren’t short-term gigs—they’re legacies for future generations.

Read the Owners in Honor post here.

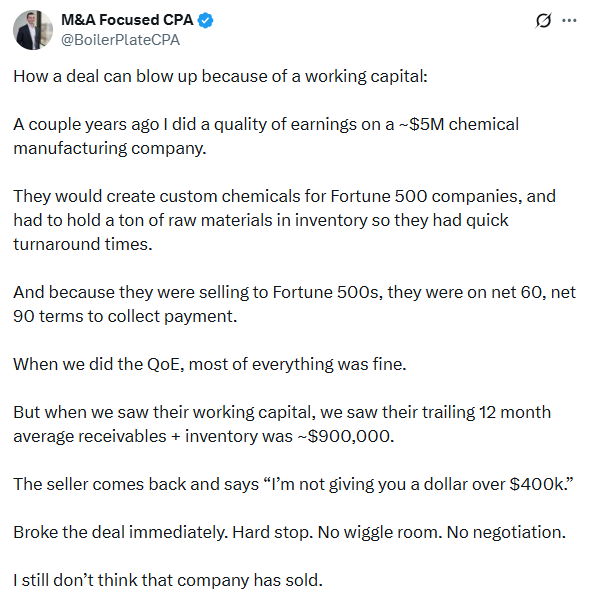

2. How working capital figures can destroy a deal

3. Earnout Payments 101: Key clauses, performance metrics, tax impacts, and dispute safeguards explained

For an earnout agreement to work smoothly, performance metrics must be clearly defined with specific calculations and examples. Vague language like "best efforts" or unclear revenue definitions tends to lead to disputes. Clarity is key.

Payment structures and timelines also need to be transparent. When both parties know exactly when payments are due and what triggers them, potential conflicts can be avoided. This clarity should extend to operational controls, ensuring buyers have clear responsibilities during the earnout period. By removing ambiguity from payment terms and timelines, the groundwork is laid for smoother execution.

Recent data shows a sharp rise in earnout-related disputes. This trend aligns with the increasing use of earnouts - 33% of deals in 2023 included earnouts, compared to 21% in 2022 and 18% in 2021.

Effective agreements also include a tiered approach to resolving disputes, starting with negotiation and moving to arbitration if necessary. Setting strict timelines for each stage of dispute resolution helps prevent drawn-out conflicts. Additionally, agreements should specify which disputes require expert review versus court involvement and include contingency plans in case the designated expert becomes unavailable.

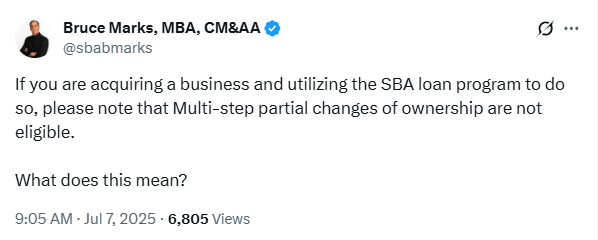

4. SBA heads up: Multi-step partial changes of ownership are a “no-go”

5. Looking at deals through an SMB lender’s lens to help buyers structure stronger, more fundable acquisitions

David C. Barnett clears up some misconceptions and talks about why you don't need a perfect pitch or magic formula to get your loan approved. He goes over what bankers are actually looking for: whether the deal will pay them back and walks through how lenders really think, by examining cash flow, your personal finances, collateral, and guarantees.

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.