Take Five #167: How to calculate how much SBA debt you can afford on a deal, and more

Top five must-reads this week in the world of SMB acquisitions and operations

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates hundreds of thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Take Five is created and sponsored by Kumo, a powerful deal aggregator to help supercharge your deal sourcing at withkumo.com.

What can you do with Kumo?

Browse 120,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily email for deals that match your search criteria.

Take Five #167: How to calculate how much SBA debt you can afford on a deal, and more

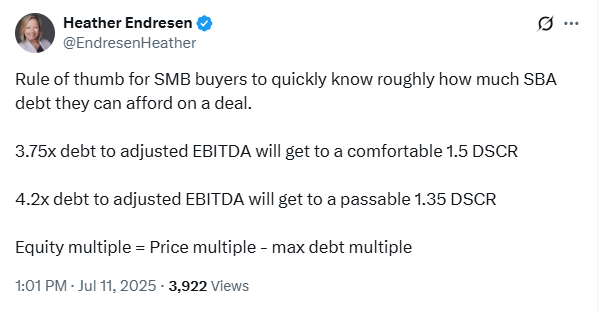

1. How to calculate how much SBA debt you can afford on a deal

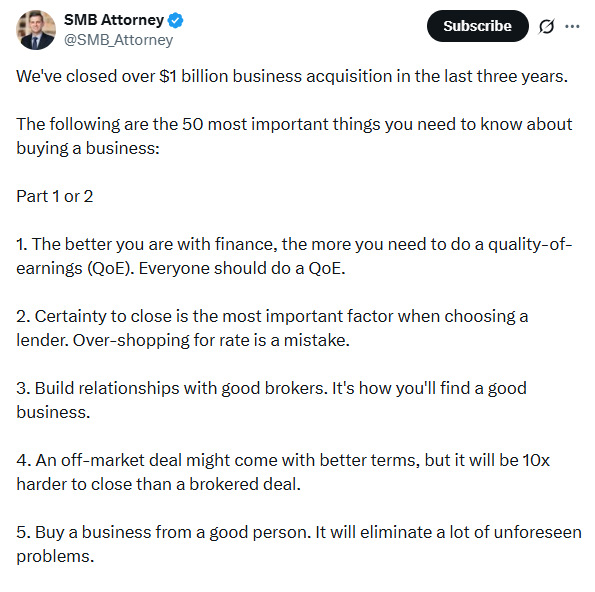

2. “The 50 most important things you need to know about buying a business”

3. Don’t overpay for a seasonal SMB: Time series tools for revenue modeling spot trends, predict future performance

Seasonal revenue modeling is critical when buying a small or medium-sized business (SMB). Ignoring seasonal patterns can lead to overvalued deals, cash flow issues, and poor financial planning. Here's what you need to know:

Why It Matters: Seasonal trends impact financial projections, valuations, and operational planning.

How It Works: Analyze historical sales data to identify predictable revenue patterns.

Steps to Model Seasonality:

Collect and clean at least three years of revenue data.

Use tools like time series decomposition, seasonal indices, and autocorrelation analysis.

Segment data by product, customer type, or region for deeper insights.

Financial Adjustments: Build seasonality into forecasts, adjust working capital, and align financing with revenue cycles.

Technology's Role: AI and analytics tools simplify identifying trends and improving forecasts.

4. Well-informed individual buyers crush impersonal PE spam in sellers' inboxes

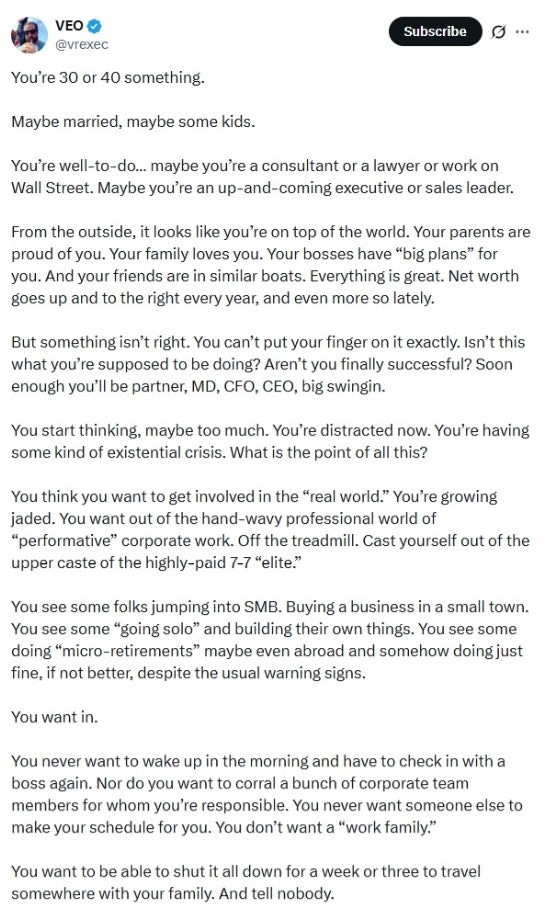

5. Hot take: A truer ETA tweet has never been tweeted (classic corporate escape arc, all in one post)

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.