Take Five #168: AI-powered deal analysis tools streamline searches, save $$, catch contract discrepancies, and more

Top five must-reads this week in the world of SMB acquisitions and operations

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates hundreds of thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Take Five is created and sponsored by Kumo, a powerful deal aggregator to help supercharge your deal sourcing at withkumo.com.

What can you do with Kumo?

Browse 120,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily email for deals that match your search criteria.

Take Five #168: AI-powered deal analysis tools streamline searches, save $$, catch contract discrepancies, and more

1. Common-sense checklist covers questions to ask, red flags to watch for when reviewing a prospective business

2. How to fund a business acquisition with a Sale Leaseback (SLB)

3. AI-powered deal tracking and analysis tools streamline searches, save $$, catch contract discrepancies

At the heart of effective deal tracking lies a centralized deal repository. By consolidating all deal data into a single, easily accessible location, these tools eliminate the chaos of scattered spreadsheets and endless email chains. This ensures that every stage - from initial contact to closing - is thoroughly tracked.

Real-time updates add another layer of efficiency, offering instant visibility into the deal pipeline. Teams can respond quickly to changes, keeping deals on track. For instance, businesses using deal tracking software report closing 36% more deals on average, while HubSpot customers saw a 129% increase in leads after just one year of implementation. Beyond organization, advanced analytics integrated into these platforms help refine risk assessment and identify opportunities.

AI-Driven Analytics for Opportunities and Risk Management

AI-powered analytics bring unmatched clarity to deal tracking by analyzing massive amounts of both structured and unstructured data. These tools evaluate factors like market conditions, customer behaviors, regulatory changes, and external threats, delivering predictive insights that help businesses manage risks and seize opportunities.

For example, manual contract reviews typically take 92 minutes per contract, but AI tools can handle the same task in just 26 seconds. Similarly, AI-driven due diligence significantly reduces costs - normally 0.5% to 2% of the deal size - by cutting down both time and expenses. Technologies like machine learning, natural language processing, and robotic process automation detect anomalies and reduce manual effort by up to 80%. In one real estate brokerage, implementing AI-enhanced tracking reduced the deal fall-through rate by 23% within three months.

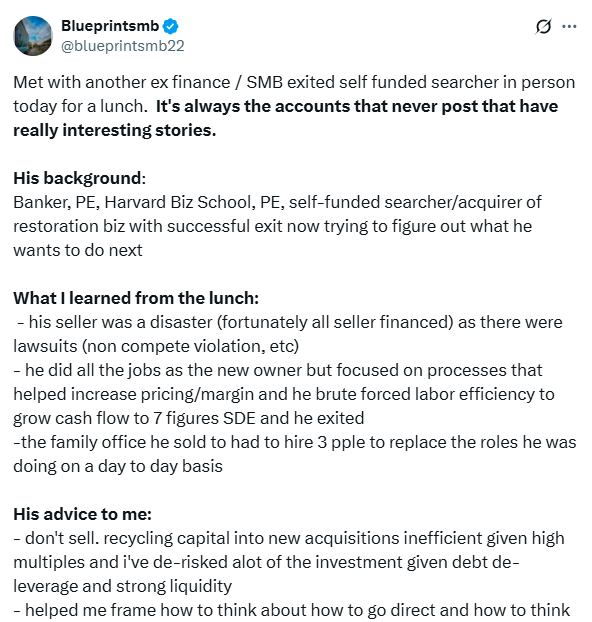

4. Lessons from a former-finance searcher who bought, scaled, and sold an SMB with 7-figure SDE

5. Podcast Interview: “He Bought a $1.2 Million Accounting Firm and Then Tripled It”

Patrick Dichter, owner of Appletree, breaks down how he bought his first accounting firm for $1.2M and scaled through two tuck-in acquisitions…tripling revenue along the way and weathering the gut-punch of a 40% revenue drop overnight. He shares sharp insights on deal structure, offshore hiring, and what makes or breaks a quality of earnings report.

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.