Take Five #180: The traits that separate exceptional business buyers from average searchers in today’s ETA landscape, and more

Top five must-reads this week in the world of SMB acquisitions and operations

Subscribe to Take Five to get our top 5 quick weekly reads on the world of SMB, M&A, and EtA from the team at Kumo. Kumo aggregates hundreds of thousands of deals into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.

Take Five is created and sponsored by Kumo, a powerful deal aggregator to help supercharge your deal sourcing at withkumo.com.

What can you do with Kumo?

Browse 120,000+ deals from hundreds of brokers and every major marketplace, with 700+ unique deals added daily.

Save time and stop reviewing duplicate deals. Kumo matches identical deals across hundreds of sources so you can view unique business opportunities, even if they’re slightly different across different websites.

Get a daily email for deals that match your search criteria.

Take Five #180: The traits that separate exceptional business buyers from average searchers in today’s ETA landscape, and more

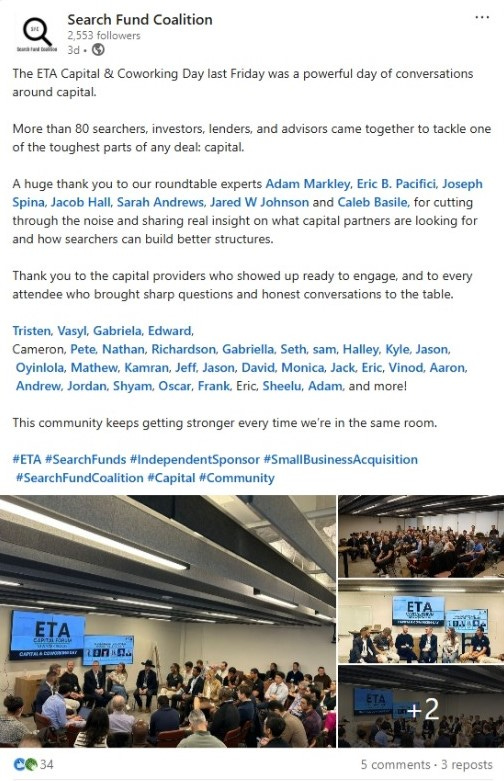

1. ETA Capital Day Recap: 80+ searchers, investors, and lenders shared hard-won insights on building smarter capital stacks

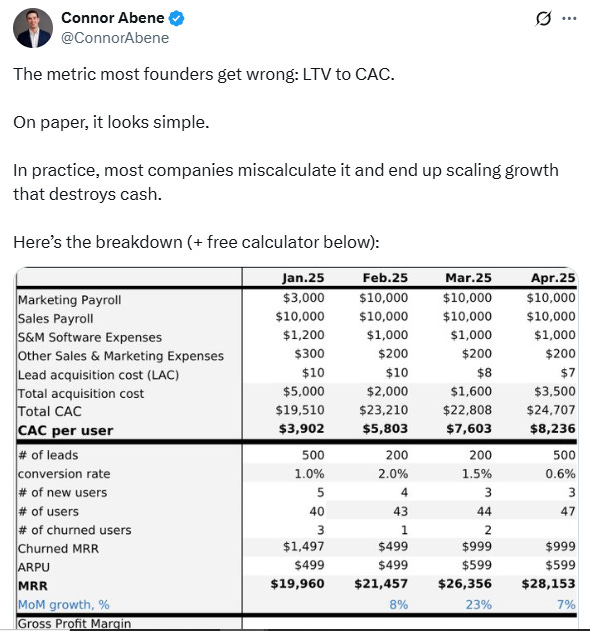

2. Growth only works when LTV:CAC math holds up

3. The traits that separate exceptional business buyers from average searchers in today’s ETA landscape

Business Mindset and Persistence

Adaptability is the foundation of successful acquisitions. Top buyers tailor their strategies to fit the unique needs of each business. Whether it’s adjusting financing options, timelines, or their role in the company, they remain flexible. For instance, if a seller is worried about employee retention, a buyer might propose retention bonuses or a short-term consulting role for the seller. If traditional financing falls through, they quickly pivot to alternatives like SBA loans or seller financing.

Persistence without rigidity is another hallmark of successful buyers. They understand that finding the right business is a marathon, not a sprint. It often takes 12 to 18 months of active searching. During this period, they consistently follow up on leads, even those that initially seemed unpromising, and nurture relationships that could lead to future opportunities. At the same time, they know when to walk away from deals that don’t align with their criteria or carry too much risk.

Rejection doesn’t deter them - it’s treated as a learning opportunity. By analyzing feedback and tracking responses, they refine their approach over time. This mindset is the backbone of the deal-sourcing strategies discussed in the next section.

Financial Analysis Skills

Sharp financial analysis separates serious buyers from the rest. Successful buyers can quickly determine whether a business’s financial statements tell a consistent and reliable story. They don’t just focus on revenue; they dig into cash flow trends, seasonal changes, and profit margin stability.

These buyers are well-versed in industry-specific financial benchmarks. For example, they know what gross margins to expect in manufacturing versus service industries. They can also spot warning signs, such as declining customer concentration, irregular expenses, or cash flow discrepancies.

Expertise in deal structuring is another critical skill. Successful buyers often use creative approaches like earnouts, seller financing, or asset-based lending to reduce upfront costs while reassuring sellers about the deal’s integrity. This creativity can give them an edge, even when competing against all-cash offers.

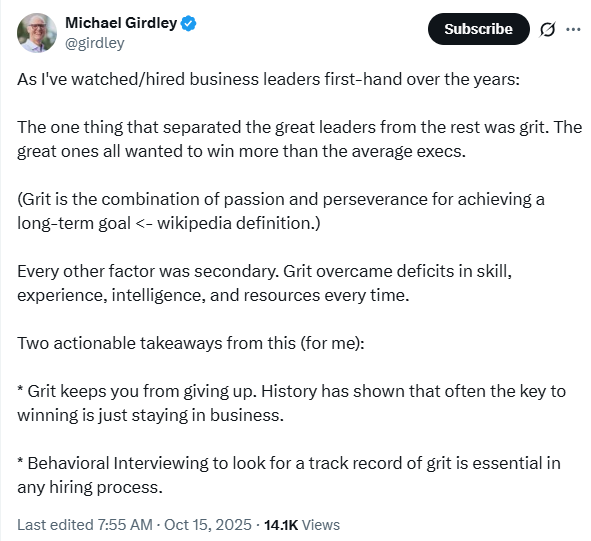

4. Grit almost always outperforms intelligence, experience, and skill in leadership (and life, probably)

5. HoldCo Builders Interview: Entrepreneur Xavier Helgesen talks search, strategies, risks and rewards, and takeaways after looking at 1000s of deals

Entrepreneur and investor Xavier Helgesen shares his lessons from over 20 business acquisitions and a $100M+ portfolio. In this conversation, he breaks down how to find great deals, hire strong CEOs, and avoid common small business pitfalls. From niche market strategies to the value of persistence and people, Helgesen’s insights offer a roadmap for anyone building or buying small companies.

Loved what you read? Subscribe to Take Five to get our top quick reads every week from the team at Kumo. Kumo aggregates thousands of sources into one easy-to-use platform so that you can spend less time sourcing, and more time closing deals.